Buying a home is one of the most significant financial commitments many people will make in their lives. Once you take out a mortgage, your main concern will likely be making monthly payments, which can last for decades. To fully understand the financial implications of your mortgage, it’s essential to comprehend the concept of amortization and how the mortgage amortization schedule works.

In this article, we will explore what an amortization schedule is, how it works, its benefits, and how you can use it to manage your mortgage and finances better.

1. What Is Mortgage Amortization?

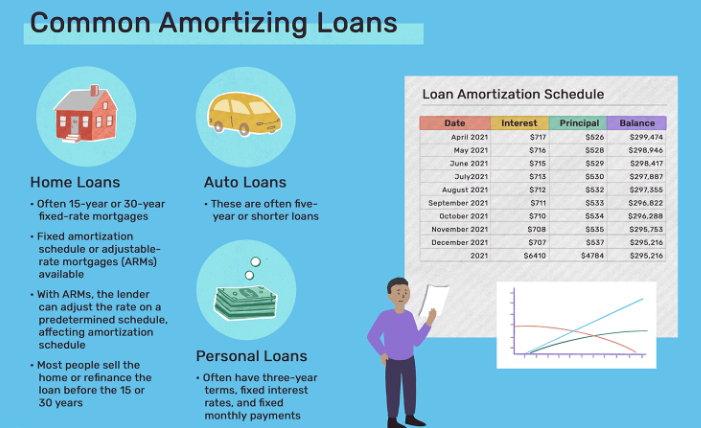

Mortgage amortization refers to the process of gradually paying off a mortgage loan over time through regular, typically monthly, payments. When you take out a mortgage, you are agreeing to repay the principal (the amount you borrowed) along with interest over the loan’s term, which can range from 15 to 30 years or more.

Each mortgage payment you make is divided into two parts:

- Principal: The amount of money that goes toward reducing the loan balance.

- Interest: The fee you pay the lender for borrowing the money, calculated as a percentage of the remaining loan balance.

Over the course of the loan, the balance of the loan decreases as you continue making payments. Initially, the interest portion of your payments is larger, and the principal portion is smaller. As time goes on, the amount you pay toward the principal increases, while the amount you pay toward interest decreases.

2. What is a Mortgage Amortization Schedule?

A mortgage amortization schedule is a detailed table that shows each payment you will make over the life of your loan. It breaks down each payment by the amount that goes toward the interest and the amount that goes toward the principal. The schedule also shows your remaining balance after each payment is made.

The amortization schedule provides a clear, visual representation of how your loan balance decreases over time, which can help you understand how much you’re paying in interest and how long it will take to pay off your mortgage.

3. How Does an Amortization Schedule Work?

Amortization schedules are built using a mathematical formula that calculates the loan payment for a given interest rate, loan amount, and loan term. Once your loan is originated, the lender will use this formula to determine your fixed monthly payment (if you have a fixed-rate mortgage). This payment will be the same throughout the term of the loan, although the portion allocated to interest and principal will change over time.

Here’s an example of how an amortization schedule works:

- Loan amount (Principal): $300,000

- Interest rate: 4%

- Loan term: 30 years (360 months)

The monthly payment is calculated based on the loan amount, the interest rate, and the loan term. In this case, your monthly payment will be approximately $1,432 (excluding taxes, insurance, and other fees). This payment remains the same every month, but the breakdown between principal and interest will change.

For the first payment:

- A larger portion of the $1,432 will go toward interest (about $1,000), while a smaller portion (around $432) will go toward paying down the principal balance.

- Over time, as the loan balance decreases, the interest portion of the payment will decrease, and more of your monthly payment will be applied to the principal.

The schedule continues like this for the entire 30 years (or however long your mortgage term is). As you get closer to the end of the loan, more of your payment will be applied to the principal, and less will go toward interest.

4. Why Is an Amortization Schedule Important?

Understanding your mortgage amortization schedule is important for several reasons:

1. It Helps You Understand How Your Payments Are Applied

By reviewing your amortization schedule, you can see exactly how your payments are applied toward the interest and principal each month. This can help you understand the cost of borrowing and how long it will take to pay off your loan. It also highlights how much interest you will pay over the life of the loan.

2. It Helps You Track Your Loan Progress

With an amortization schedule, you can track the progress of your loan. You’ll see how much of your loan balance remains after each payment, which helps you see how quickly your loan is being paid down. This can also be motivating, as you see the balance decrease over time.

3. It Provides Insight into Refinancing or Prepayment Decisions

If you’re considering refinancing your mortgage or making additional payments to pay off your loan early, the amortization schedule can be a useful tool. It shows you how much interest you are paying, so you can assess whether paying extra toward your principal is a good strategy to save on interest over the long term.

For example, paying down your mortgage more quickly can reduce the amount of interest you pay over time. If you make additional payments toward your principal, the schedule will show how much faster you’ll pay off your mortgage, which can help you decide if it’s worth it.

4. It Assists in Tax Planning

Homeowners who itemize deductions can deduct mortgage interest payments on their taxes. By reviewing your amortization schedule, you can see exactly how much interest you’re paying each year, which can help you plan for tax season.

5. How to Read a Mortgage Amortization Schedule

A mortgage amortization schedule contains several key pieces of information that will help you understand your mortgage payments:

- Payment Number: This is the sequential number of the payment you will make. The first payment is 1, the second is 2, and so on, until your loan is paid off.

- Payment Date: This column shows the due date for each mortgage payment. For most mortgages, the due date is the same every month.

- Payment Amount: This is the total amount of the mortgage payment. For fixed-rate mortgages, this amount stays the same every month.

- Principal Payment: This is the portion of the payment that goes toward reducing the loan balance (the principal).

- Interest Payment: This is the portion of the payment that goes toward paying the lender’s interest charge on the loan.

- Remaining Balance: This shows the remaining loan balance after each payment has been made.

Let’s take a closer look at a simplified example of the first few rows of a mortgage amortization schedule:

| Payment # | Payment Date | Payment Amount | Principal Payment | Interest Payment | Remaining Balance |

|---|---|---|---|---|---|

| 1 | 01/01/2023 | $1,432 | $432 | $1,000 | $299,568 |

| 2 | 02/01/2023 | $1,432 | $434 | $998 | $299,134 |

| 3 | 03/01/2023 | $1,432 | $436 | $996 | $298,698 |

| … | … | … | … | … | … |

| 360 | 12/01/2052 | $1,432 | $1,432 | $5 | $0 |

As you can see, the principal payment increases gradually, while the interest payment decreases over time. With each passing month, more of the payment goes toward reducing the principal balance, and less goes toward interest.

6. Benefits of Making Extra Payments

Making extra payments toward your mortgage can significantly shorten the time it takes to pay off your loan and reduce the overall interest cost. For example:

- If you make an extra payment each year, it can reduce your mortgage term by several years, saving you tens of thousands of dollars in interest.

- Even making a small additional payment each month toward the principal will speed up the payoff process and reduce your total interest payments.

Your amortization schedule will show you exactly how these extra payments will affect your loan balance, so you can see the benefits in real time.

7. Conclusion

A mortgage amortization schedule is a critical tool for understanding how your loan works, tracking your progress, and making more informed decisions about your finances. It provides a detailed breakdown of your mortgage payments, showing how much is going toward interest versus the principal, and allowing you to see how long it will take to pay off your mortgage.

Whether you are looking to pay off your mortgage more quickly, save on interest, or simply understand the cost of borrowing, an amortization schedule can give you the insight you need to make the best choices for your financial future.